Why the Staking is will be the Next Big Thing in the Crypto World

The cryptocurrency landscape is constantly evolving, and one trend that has gained significant traction in recent years is staking. Once a niche concept, staking has emerged as a popular and lucrative way for investors to earn passive income on their digital assets. This article explores the reasons why staking is considered the next big thing in the crypto world and how it can benefit investors.

Understanding Staking

At its core, staking involves participating in the proof-of-stake (PoS) consensus mechanism, which is an alternative to the traditional proof-of-work (PoW) model used by cryptocurrencies like Bitcoin. In a PoS system, instead of mining, users can “stake” their coins by locking them in a wallet to support the network’s operations, such as validating transactions and securing the blockchain. In return for their participation, stakers receive rewards, typically in the form of additional cryptocurrency tokens.

The Benefits of Staking

- Passive Income: Staking allows investors to earn rewards simply by holding their coins, creating a source of passive income. This is particularly appealing in a market where many investors seek ways to maximize their returns without actively trading.

- Lower Energy Consumption: Unlike PoW mining, which requires vast amounts of computational power and energy, staking is much more environmentally friendly. This shift towards energy-efficient consensus mechanisms aligns with growing concerns about sustainability in the crypto space.

- Network Security: By staking their assets, users help enhance the security and functionality of the blockchain network. A higher number of staked coins typically translates to greater security, making the network more resilient against attacks.

- Incentivizing Long-Term Holding: Staking encourages investors to hold their assets for extended periods, fostering a more stable market. This long-term perspective can help reduce volatility and promote healthier price action.

- Diverse Opportunities: The range of cryptocurrencies that offer staking has expanded significantly. Investors can choose from various projects, each with unique features, rewards, and risks, allowing for diversification in their portfolios.

The Rise of Decentralized Finance (DeFi)

Staking has become increasingly intertwined with the rise of Decentralized Finance (DeFi). Many DeFi protocols incorporate staking mechanisms to enhance liquidity, governance, and user engagement. This growing trend has led to innovative financial products, such as yield farming and liquidity pools, where users can stake their assets to earn higher returns.

How to Get Started with Staking

For those interested in getting started with staking, here are some essential steps:

- Choose Your Cryptocurrency: Research various cryptocurrencies that offer staking options. Popular choices include Ethereum 2.0, Cardano, Polkadot, and Tezos, among others.

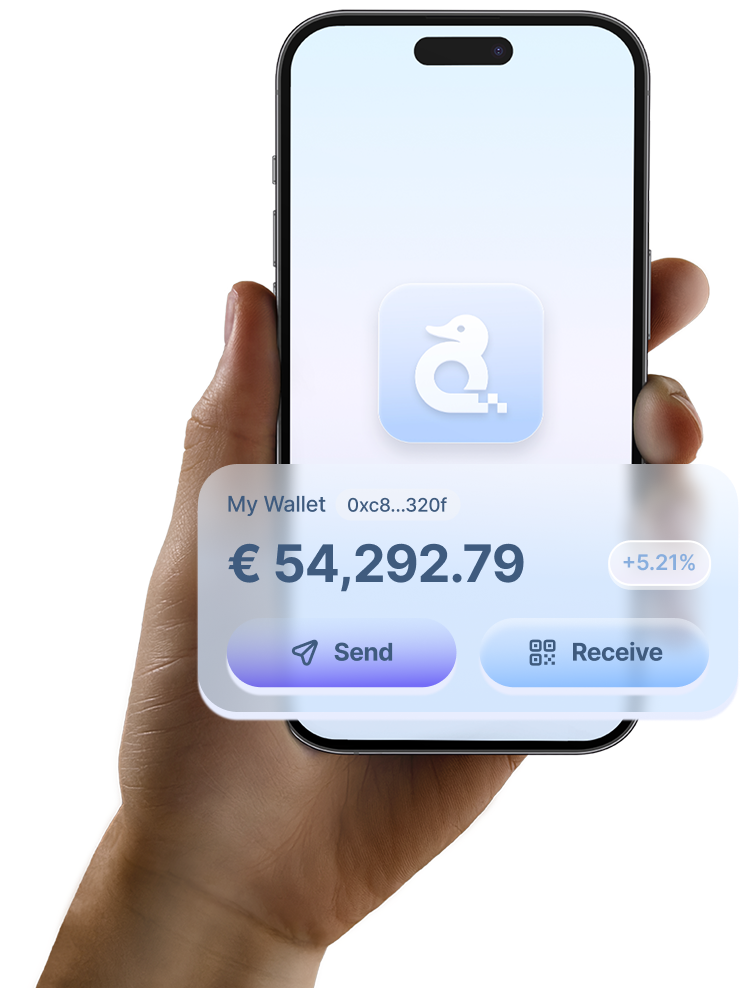

- Select a Wallet: Ensure you have a compatible wallet that supports staking for your chosen cryptocurrency. Some exchanges also offer staking services directly on their platforms.

- Stake Your Coins: Follow the instructions provided by your wallet or exchange to stake your coins. Be sure to familiarize yourself with the specific requirements and potential lock-up periods.

- Monitor Your Rewards: Keep track of your staked assets and the rewards you earn. Regularly reviewing your staking performance can help you make informed decisions about your investment strategy.

Potential Risks

While staking offers numerous benefits, it is essential to be aware of potential risks:

- Market Volatility: The value of staked assets can fluctuate significantly, impacting the overall returns.

- Lock-Up Periods: Some staking protocols require coins to be locked for a specific duration, which can limit liquidity.

- Technical Risks: Issues such as bugs in the staking protocol or failures in the underlying blockchain can pose risks to staked assets.

Conclusion

Staking is poised to become a cornerstone of the cryptocurrency ecosystem, offering investors a unique opportunity to earn passive income while supporting network security and sustainability. As more projects adopt proof-of-stake mechanisms and the DeFi space continues to grow, staking will likely attract an increasingly diverse array of participants. By staying informed and understanding the associated risks, investors can harness the potential of staking and be part of the next big thing in the crypto world.

English (en)

English (en)